The Up Round #15

The Memo

Hello and welcome back to The Up Round! As a reminder, this is a "round-up" of relevant news and resources for fund managers building a best-in-class firm. Expect us to land in your inbox every other weekend.

In curating this week's news, a few things stuck out: 1) the fundraising activity on the LP-side of the equation; 2) a focus on valuations and having trust in the policies and methods that support them; 3) liquidity! I suspect point two could easily vie for theme of the year if we were to do a look back in 12 months time.

In speaking to a couple of our more active LPs at Dynamo on the topic, the statement was "We don't know if any fund is doing this well." and another "Your statements around relevant comps and performance already puts you in the top 5% of managers on this topic." I heard separately that one endowment LP attended a AGM in early December only to get a notice 24 hours later that those same funds were marked down 50%! This is an area many fund managers are being forced to quickly get up to speed. While I don't have everything mastered, I'd suggest leading with transparency- regardless of the outcome, this begets trust which is at the core of every relationship.

Before I sign off, I started a new series called Field Notes which is my short observations/reflections/thoughts on some aspect of building a venture firm or the VC industry as a whole. Find my first post here (second post coming soon!).

X’s & O’s of Firm Building

LPs Doubt Venture Funds' Startup Valuations (link). A discussion featuring LPs such as Allocate, Sapphire, and Reference Capital highlighting the importance of GPs marking their portfolio values correctly. Entering audit season, this is top of mind for most LPs and a great way for GPs to build trust and credibility by fostering transparency on the topic.

In Search of Liquidity: Navigating Today’s Illiquid Market as a GP (link). Industry Ventures discuss two primary ways for GPs to drive liquidity for their LPs - secondaries and buyouts. While there is a component of this that is content marketing for Industry's strategies, themselves, it is a good primer chockfull of interesting data. Most notably was the rise of PE in providing exits for venture-backed companies - 22% of all exits in 2023 were buyouts.

🎙️ TWIST: Michael Kim of Cendana Discussing Various Aspects of (link). I have the good fortune of calling Michael and the Cendana team a LP of ours at Dynamo and get the benefit of their perspectives on a variety of firm building topics. I'd point out a couple parts of this conversation: evaluating different GP strategies for secondary deals at ~20min and how LPs look at backing outspoken GPs at ~49min.

NVCA/PitchBook Q4 Venture Industry Data (link). Published late last week, the data validates what everyone else knew, 2023 was a tough year. But what might be interesting is that total transaction volume of $171B was only off by ~1.5% vs 2019 levels (pre-COVID). Additionally, valuations at seed continue to tick higher whereas all other rounds have seen a reduction - expect less of an uplift at Series A or a reduction in graduation rates if this trend continues.

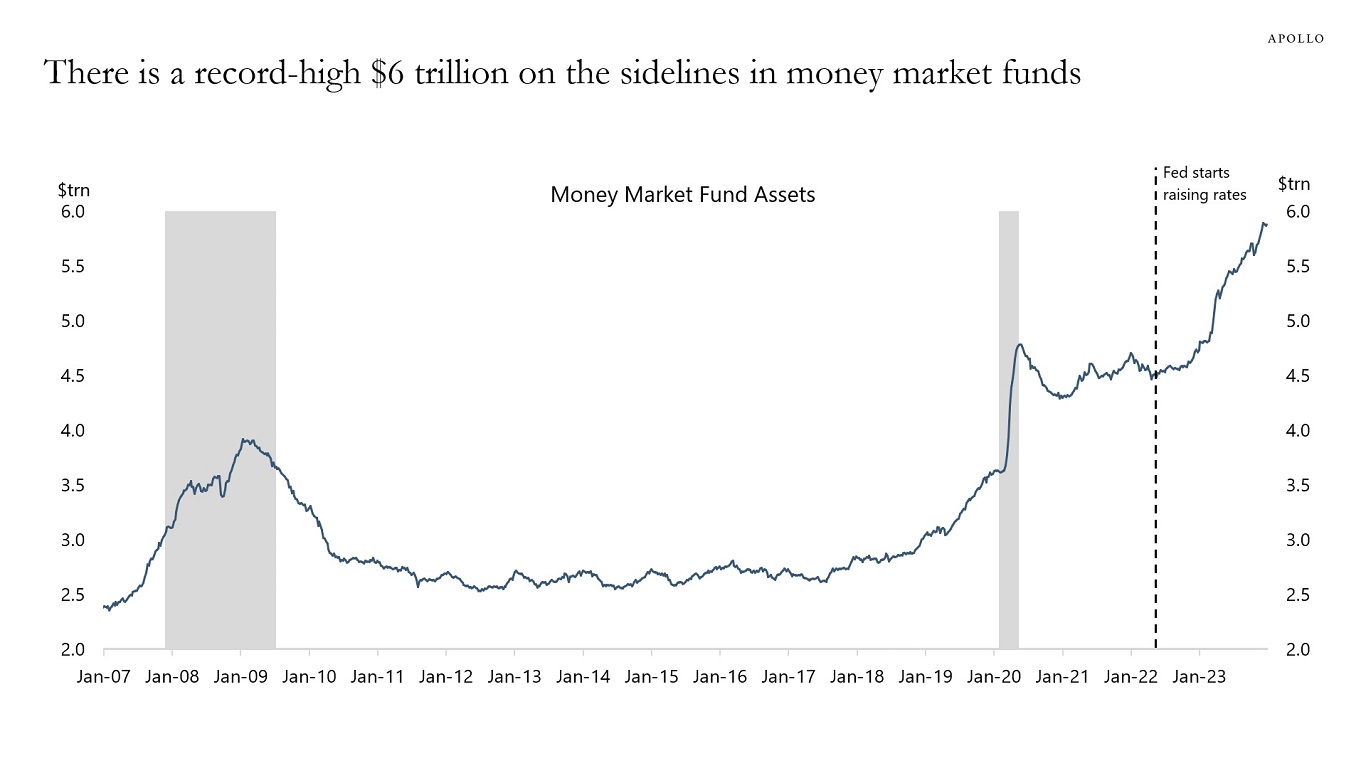

Howard Marks on Easy Money (link) via Jon Bradford. From 2009 through 2014, I was an avid reader of Marks and consumed his old memos voraciously. This memo is a must read for those looking to fully understand the impact of rates and "easy money" on asset allocation (and VC as a result). While short term rates changes may not be entirely important as a VC (given the holding period), understanding cycles and how to navigate them is - both for business building and fund management. Separately, I ran into the below chart from Apollo earlier in the week. While this isn't dry powder earmarked for venture or PE, broadly, one has to think that some of this capital might make it's way back into the asset class if rates are cut (disclaimer: I don't believe they will be).

Fund Debuts

Debut of INDIE Fund I (link). The fund will seek to write $50k- $2M investments with flexibility on stage and structure. INDIE is well known for shunning the conventional approach to venture with the goals of backing founders who are independent thinkers, value strong company culture, and focused on controlling their own destiny/maintaining optionality.

1am Gaming Emerges from Stealth with $120M AUM (link). 1am invests in content, platforms, and tech in the videogame industry exclusively (side note: my kids would probably think I'm a lot cooler if I invested in this space). The firm is finishing investment of reserves out of it's debut $60M fund and ramping investments from it's second $60M fund with check sizes of $2-3M for double digit ownership and a board seat at the pre-seed or seed stages.

Prequel Ventures Announces First Close (link). Prequel Ventures is focused on pre-seed supply chain startups in Europe. Other sources report that the firm has closed on about 10% of it's €10M target thus far.

Kost Capital Announces First Close of €25M Fund I (link). The fund will invest in pre-seed and seed startups across Europe, focusing on B2B inputs in the future of food. They'e currently secured a portion of the fund with a first close from the Danish Sovereign Wealth Fund, EIFO.

Other Fun(d) Stuff

Countdown Capital Shuts Down (link). This shutdown was very public (perhaps more than it needed to be). It also created a lot of conversation to start the year amongst GPs who are hoping for a less rocky 2024. One even said, "we tend to get lumped into the hardtech/dual use category, will this mean there are less believers?" All said, I can't but help to wonder whether part of the underlying issues were related to portfolio construction (or lack of).

Venrock Closes Fund 10 at $650M (link). What I think is the most interesting aspect of a tenth vintage announcement is that the firm decided to increase it's fund size for the first time in a decade. The reasoning behind this is simple - "Over the next few years, Venrock will need more follow-on capital if it wants to save the companies in its portfolio it thinks are worth saving."

Exponent Founders Capital Closes $75M Fund II (link). The firm raised a debut $50M fund led by a team formerly from Plaid, Robinhood and Ramp. It focuses on enterprise SaaS, fintech, infrastructure and GTM (go to market) software companies. Fund I invested in about 40 startups including Apollo.io, Chronosphere, and EvenUp. Fund II will invest $500k-$5M for 5-10% ownership.

Enconmeda Fund II Announces First Close of €50M Fund II (link). The first close of $15M to continue their focus on southern European and LatAm startups.

Talent Tracker

Keith Rabois Returning to Khosla Ventures (link). Five years after leaving for Founders Fund, Rabois returns to Khosla on the back of the firm raising $3B in fresh funds. Rabois will remain in Miami and it's already expected that there will be "rigorous debate" on what drives alpha amongst VCs and a potential evolution at Khosla as a result.

Ruth Foxe Blader Spinning Out of Anthemis (link). Blader is leaving Anthemis after seven years to build her own firm, Foxe Capital. What's interesting is the spinout structure. Blader will sub advise the Anthemis funds till the capital has been deployed (expected to be late 2024) and only then begin fundraising.

Jared Hecht Joins USV as Venture Partner (link). Hecht formerly founded GroupMe and Fundera and was also an early employee at tumblr. In his own words, "I want to keep my head up, remain entrepreneurial, and focus on a new abstraction layer. Instead of one specific problem and solution, I am most excited about bold, thematic change"

Bain Capital Ventures Announces Rak Garg at Partner (link). Garg has been with BCV for three years and previously at Atlassian serving as product lead. Alongside this, Abby Meyers was promoted to Principal. Garg will continue to focus on enterprise SaaS opportunities at seed and Series A.

2048 Promotes Zann Ali to Partner (link). Ali joined in 2019 when the firm started and was key in setting up 2048's internal infrastructure, finance, and legal. As part of the announcement, Zach Johnston was promoted to Associate.

Northzone Announces Promotions (link). Michelle Nacouzi has been promoted to Principal in New York, Pascual Cortés-Monroy E. to Vice President in London, Aaron Liu to Vice President in New York and Dominik Faruk Esen has been promoted to Vice President in Stockholm. In addition there were four promotions on the Operations team as well.

LP Radar

Lexington Closes $22.7B Fund X for Secondaries (link). Leaning into the trend of GPs organizing liquidity solutions for LPs, Fund X was originally targeting $15B (Fund IX was $14B, 2020 vintage). The firm also expects 2023 to be the third year in a row where secondary transaction volumes exceed $100B.

Vintage Closes $200M Growth IV (link). Operating alongside it's FoF and secondary platforms, Growth IV will invest in 15-20 Israeli, European, and US growth-stage technology startups. What's also interesting is that Vintage has built a way to track the value it brings portfolio companies... ">3,300 meetings and introductions between startups and corporations, resulting in nearly 300 known purchase orders or paid proof of concepts for startups from global corporations and over $200 million in business."

GREE Announces First FoF of $53M for US Managers (link). The new fund is supported by listed companies and overseas family offices and complements the existing Japan-focused FoF strategy. Existing US fund investments include Hustle Fund, Behind Genius Ventures, the mini fund, Overwater Ventures, Conscience VC, as well as established funds like Upfront Ventures, Future Ventures, and NFX.

University of Michigan Endowment Major LP in Sam Altman's Hydrazine Capital (link). The investment is the second in one of Hydrazine's funds and comes after Michigan invested in both OpenAI as well as the OpenAI fund. Peeling back the onion, Michigan invested $105M in Hydrazine II and $75M into the fourth fund. The endowment has also invested in a $20M SPV run by the Altman brothers. Comparing it to Michigan's other LP investments the Hydrazine investments are large for a group where checks top out around $50M... GC with $62M, 8VC with $50M, and a16z with $15M.

Louisiana Teachers Planning to Invest $300-400M into VC in 2024 (link). The bummer is that none of it appears to be going to emerging managers but more established platforms including $50M to Insight and $100M to a Hamilton Lane co-invest vehicle mostly focused on hard to access VC and growth managers. The move is part of the pension program's push to increase their exposure to venture from 3% to 7% in 2023 (at 6.5% as of June 2023). Other funds Louisiana Teachers has backed include Arch Venture Partners, Bond, Costanoa Ventures, General Catalyst, Drive Capital, GGV Capital, Greycroft, Iconiq, Innovation Endeavors, Oak HC/FT and Spark Capital.