The Up Round #14

The Memo

Welcome to the 14th issue of The Up Round. As a reminder, this is a "round-up" of relevant news and resources for fund managers building a best-in-class firm. Expect us to land in your inbox every other weekend.

Welcome to the final weeks of 2023! This will be the final Up Round for the year.

It’s been a long year in the world of startups and venture. I think many will look back on 2023 as the year where the venture bubble was popped. The caveat is that we won’t know till mid-2024 if this is the case given that year-end 2023 fund valuations take time to flow-through to the publicly available datasets and reports. As I was thinking about this, I was reminded of a LP conversation I had with a FO investor earlier this fall who said that they expect all of their funds to have a reduction in NAV if the GPs are doing their job properly.

Looking ahead, I’m not so sure 2024 will be any rosier in terms of NAV performance or liquidity. Founders and LPs who know my stance (and my firm’s) know that we are pessimistic given our belief that we’ll see a higher rate environment persist longer than most others. That said, the Fed suggesting they’re done with their rate hikes could counter our assertion as can loose fiscal policy that continues to pump money into the system in various ways. All said, I don’t have a crystal ball and really my job is to invest in companies that are durable and withstand multiple cycles.

Please have a Happy Holiday and enjoy time with loved ones. See ya in 2024.

Please subscribe using the button below. If you're already a subscriber, thank you!

X’s & O’s of Firm Building

Why VC Does Not Scale (link). From Sante Ventures- “a smaller fund is roughly 50 percent more likely to return more than 2.5-times TVPI than a large one.” This is an interesting, data-driven report incorporating both Pitchbook and Sante’s own datasets. The report interestingly also calls out that venture-backed exit values tend to sit below $350M so as people do the RtF math, it becomes obvious that a fund <$100M might be advantaged in consistently putting up quality returns (3x net).

Deep Dive on VC Return Profiles (link). “Patience is a virtue, especially in venture. One of the biggest mistakes an investor can make is to let go of an outlier investment too early. Expect DPI to look dramatically different in year 10 than in year 5 - and get those few extra years of compounding in if you can”

Understanding NAV Loans (link). While this is PE-centric, the capital strategies found in buyout tend to make their way into the world of venture over-time. NAV loans are backed by a fund’s assets/investments and can range in tenor from three to five years. It can be used to help provide partial liquidity to LPs and then retired as portfolio company gains are realized.

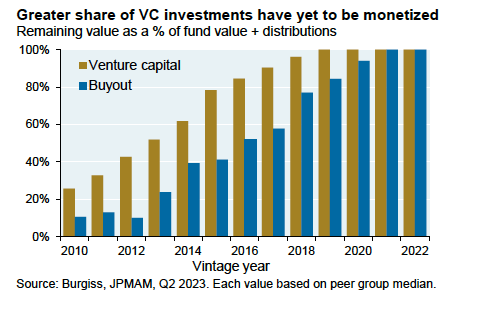

2023 JPM Alts Review (link). In their biennial report, JPM points out that >50% of VC returns in vintages that are eight to ten years old remain illiquid and purely on paper (page 8) and whilst the exit markets remain damped, this is likely not to change in 2024 (page 7). Lastly, it’s interesting to see that the time between rounds appears to be reverting back to the “24 month” cycle that was commonplace in 2015/2016 timeframe.

HBS: Catching Outliers: Committee Voting and the Limits of Consensus When Financing Innovation (link via Jon Bradford). The study explores the value of “champion” voting where one Partner pounds their first on the table to do a deal (often times unilaterally) vs structures with a consensus approach.

Fund Debuts

Zelda Ventures Closes $33M for Pre-seed Serial Entrepreneurs (link). Zelda is led by Suzanne Fletcher formrly of Stanford StartX and a GP at Prime Movers Lab who will only invest in founders she’s invested in previously. For context, Fletcher has made >350 investments including Sourcegraph, Hive, Alation, Turing, Dexterity and Orca Bio with 30 of them exiting already. As an aside, this might be the best name for a venture fund out there.

Climactic Raises $65M Inaugaral Fund (link). The new climate-focused seed fund is led by Josh Fesler (formerly of Freestyle) and Raj Kapoor who was at Lyft and Mayfield Fund, previously. The fund has 13 portfolio companies thus far (been investing personally since 2020) and counts several SV luminaries as LPs including Reid Hoffman, Chris Sacca, and Ev Williams. Institutional backers include Stepstone, MIO Partners, NfX, and Mayfield.

Hugo Boss Backs Collateral Good with €100M Sustainability Fund (link). The fund will invest in efforts to make the global fashion and textile industry more sustainable. Investing across 20-25 startups across the fashion value chain, the fund will write €1-3M first checks. Areas of interest include recycling of textiles, upcycled raw materials, novel dyeing materials and processes, and supply chain transparency.

Partech Closes €150M of €300M Growth Impact Fund I (link). The fund will invest in 15 B2B companies with at least €10M in sales that focus on creating an impact in areas including industrial, agri-food and the environment. LPs include Bpifrance, EIF, Legrand, LCL and Société Générale.

Other Fund Stuff

What Happened at OpenView Venture Partners? (link). After nearly two decades of operating, OpenView abruptly laid off it’s staff and seized new investments despite closing a $570M fund earlier this year. Partners started departing the firm in January and by the time November came around, Mackey Craven’s departure caught the remaining GPs by surprise. Rather than exploring the forced “generational transition” the GPs decided to provide staff w/ a multi-month severance and wind up shop. Note- this is why LPs care about the key-man clause!

Fintech Specialist, Canapi Closes $750M Fund II (link). The new fund brings firm-wide AUM to $1.4B with the banking of several large banks and financial institutions as well as institutional investors. The fund will maintain it’s focus on early growth companies but expand it’s aperture to include fraud and identity, financial infrastructure, lending and credit, payments, and real estate technology which the industry is prioritizing in the coming years.

Congruent Ventures Raises Oversubscribed $275 Fund III (link). The fund continues Congruent’s focus on investing early against their climate and sustainability thesis. The fund saw interest in excess of $600M and counts LPs such as CalSTRs, the Grantham Foundation, the University of California, Sobrato Capital, Strategic Investment Group, and new LPs including Northwestern University and Vintage Investment Partners.

Harpoon Ventures Raised $125M Fund 4 for Dual-use Startups (link). With the backing of the likes of Peter Levine (a16z) and Michael Phelps, Harpoon continues the focus on “American Dynamism” that you’ll see throughout this issue. It’s worth noting the original goal of this fund was $225M but given market conditions, the partners settled for something akin to their $122.5M Fund 3 in 2021.

Rockstart Lands €50M Fund II for AgTech (link). The fund is linked to it’s agtech accelerator program which is expected to support up to 50 startups with the fresh capital.

Talent Tracker

Jenny Fleiss Joins Initialized Capital as Partner in NYC (link). Fleiss was previously Co-founder of Rent the Runway where she led logistics and BD. Prior to Initialized, she was a Venture Partner at Torch Capital and Volition Capital. She’s also sat on the boards of several SPACs and upstart companies.

Alice Bentinck Becomes CEO of EF (link). A decade since co-founding EF, Bentinck will rise to the CEO role while Matt Clifford moves to a Talent Investing role with a focus on AI.

Michael McBride Joins GV as General Partner Focused on AI and Open Source (link). McBride joins from GitLab where he was serving as CRO for five years.

Tribe Capital CEO Arjun Sethi Names Boris Revsin Successor, Becomes CIO (link). “In venture, it’s common for the most substantial investors to drive returns and set the tone and vision for firms in their early days. As the firms scale, these investors transition into administrative and management roles — and that doesn’t always result in optimal performance outcomes. That’s what we’re trying to protect against,” Sethi said in the memo. “I am confident that with the right management team leading the way, Tribe has the potential to grow fiftyfold.”

Maria Palmer Departing Kindred (link). Palmer will step down as GP of London-based Kindred as she and her family return to the US.

LP Radar

America’s Frontier Fund Launches with $100M and Support from Tech Luminaries (link). The fund (AFF) seeks to support technology breakthroughs that are deemed to be in the national interest. Tech luminaries such as Peter Thiel, Eric Schmidt and Sam Palmisano have funded the sister non-profit think tank while the fund itself is led by Gilman Louie, formerly of In-Q-Tel. The fund is targeting $500M of which $100M has come from the state of New Mexico. It’s first investment is Roadrunner Ventures that is building a venture studio. The ambition is for AFF to invest in a network on similar venture firms across the country.

🎤 Swimming with Allocators: Michael Ashley Schulman, Chief Investment Officer and Founding Partner of Running Point Capital (link). Schulman speaks from the vantage point of a multi-family office who have increasingly become involved in the VC LP landscape. I found particular interest in: building a due diligence network (8:57); criteria for selecting venture capitalist managers (21:42); building and selling companies in challenging times (30:35).