The Up Round #11

The Memo

Welcome to issue #11 of The Up Round. As a reminder, this is a "round-up" of relevant news and resources for fund managers building a best-in-class firm. Expect us to land in your inbox every other weekend.

I had the good fortune to present at RAISE last week and the conversations in the room were very interesting. On one side of the room, you had GPs who had raised and were cheesed “to have dry powder in a down market” whereas on the other side were Fund I or Fund II GPs trying to get to a first close in what many would describe the most challenging fundraising environment in several decades. In the middle were a roster of LPs trying to manage liquidity (read, praying for exits) with almost all of them pruning their venture portfolio let-alone add to it. A few interesting sound bites:

- “Texas is proving to be a fertile ground for venture managers” to raise; be mindful of cultural differences and respect them

- Family offices all seem to be “following the herd” and acting with fear despite many being under-allocated to venture; Less sophisticated groups appear to think only coastal funds are worth the squeeze and “stand to lose out”

- There’s less concern amongst LPs on a GP reducing fund size provided they can execute on the strategy - “close and move on”

Thank you for reading The Up Round by The Multiple. This post is public so feel free to share it.

X’s & O’s of Firm Building

The Big Reset in Seed to Series A Graduation Rates is Real and Permanent (link) via Michael Kim at Cendana. With the tightening of the Series A market, seed investors and founders must align on building durable, capital-efficient companies that can thrive with limited external funding, as graduation rates from seed to Series A are likely to plummet from historical highs of 50-75% to 25% or less. Dilution is the enemy for seed investors and founders alike, so they must focus on investing capital wisely and building businesses that can drive growth and value creation with minimal capital needs going forward. This "big reset" will require honest conversations about viable fundraising paths and force greater financial discipline and focus on what I call a “durable” business models.

DPI for Pre-seed and Seed Funds (link). Pulling from a portfolio of >100 venture fund investments, historic data suggests that it generally, it takes over seven years for a pre-seed/seed fund to return any meaningful cash to LPs. Patience is a virtue, eh?

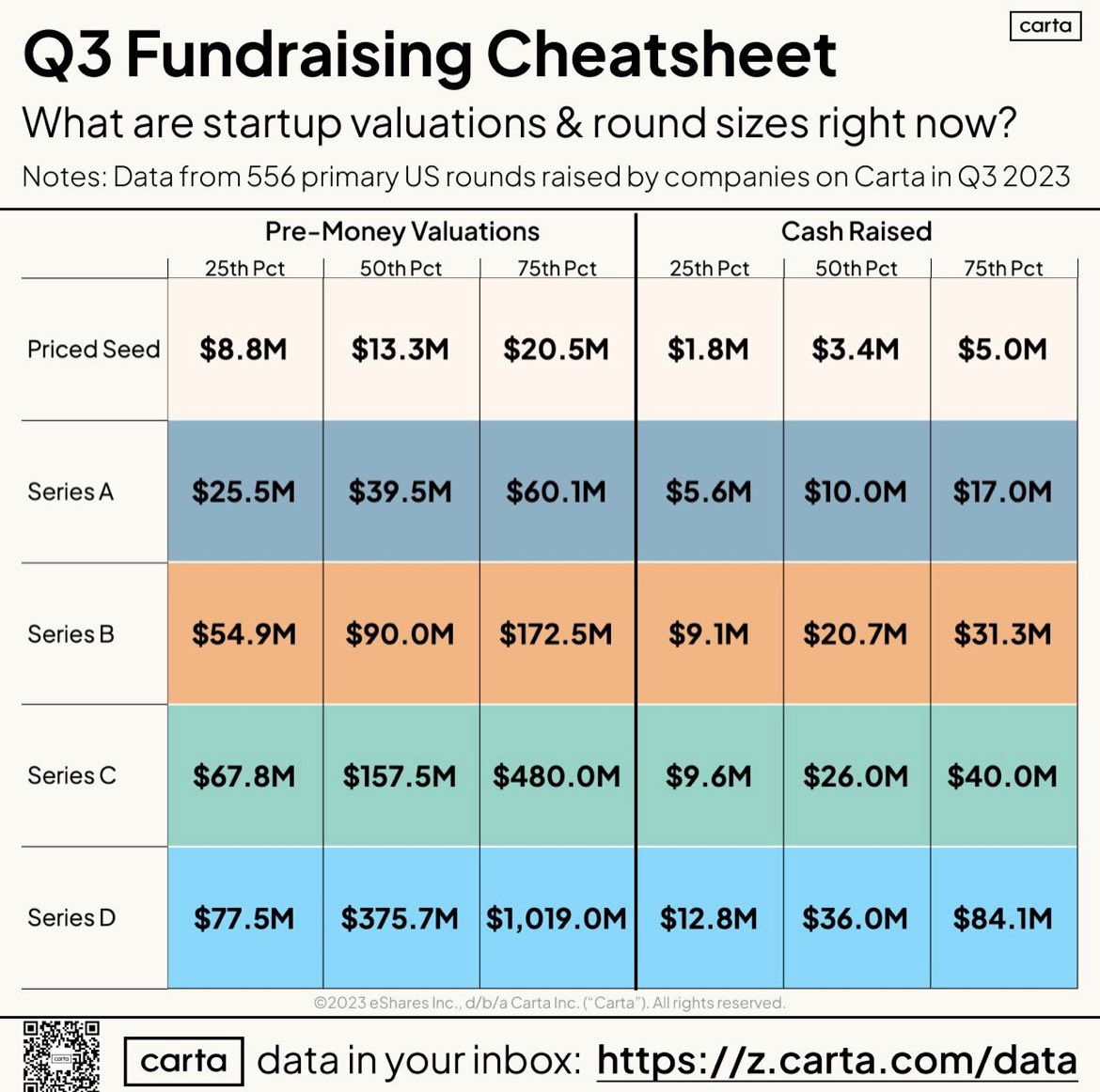

Carta Data Points: Valuations (link), 1,000 Days of Runway (link), and Predatory Deal Terms (link). A picture’s worth a thousand words - have a look!

Fund Debuts

Sheryl Sandberg Sets Up Venture Fund With Husband (link). The ex-Meta COO has set up a VC fund with her husband, Tom Bernthal called Sandberg Bernthal Venture Partners.

I4d Ventures Launches €16M Pre-seed Fund (link). The fund will write 200-500k pre-seed and seed checks in frontier technologies. I4d also teased an upcoming microfund.

2100 Launches with €30M Fund Backed by Benetton Family (link). Led by Alessandro Benetton, the heir to the family behind the United Colors of Benetton as the family’s first major foray into tech investment. “The new fund intends to invest in pre-seed to Series A startups across Europe, it will prioritise its Italian heritage: more than 50% of the €250k-750k tickets it invests in pre-seed to Series A startups will go to companies with Italian founders.”

Garuda Ventures Launches $31M First Fund (link). The fund will focus on B2B startups with $500k - $1M for a portfolio of 25-30 startups across cloud-native security, climate 2.0, intelligent applications, and commerce infrastructure. This fund followed a “proof of concept” fund of ~$3M raised in 2018.

Wellington Closes Venture Investments I at $150M (link). The fund is focused on writing initial checks up to $3M into diverse, overlooked founders and companies in sectors like B2B software, fintech and consumer; the fund is managed by Wellington's early-stage team Access Ventures, who sees opportunity in backing talented Black, Latine and women entrepreneurs to drive value creation and meaningful change in the VC ecosystem. Members of the WAV team, led by Cummings, include Frederik Groce, Sasha McKenzie, and Van Jones.

Andre Iguodala Retires to Found $200M Fund (link) via Brian Hollins at Collide Capital. The Mosaic General Partnership will be run by Iguodala and his longtime business partner Rudy Cline-Thomas. They will focus on early-stage enterprise software, fintech, and sports companies.

Norrsken22 Raises $205M for Debut Pan-African Fund (link). The fund was established in Q1’22 with a $110M first close. It’s final close saw 59% of LP capital coming from founders of 30 unicorns including Flutterwave CEO Olugbenga Agboola, Skype co-founder Niklas Zennström, iZettle co-founder Jacob de Geer, and Delivery Hero co-founder Niklas Östberg. The balance is filled by several industrial and development banks such as IFC, BII, and DFC. Approximately 50% of Norrsken’s capital will be allocated to building its portfolio with Series A and B companies; the remaining will be reserved for follow-on investments, primarily in the B and C rounds.

Other Fund Stuff

Flourish Ventures Closes $350M from Pierre Omidyar (link). Flourish Ventures, an early-stage, fintech-focused venture firm with $850M AUM, has secured $350M in new capital from sole LP Pierre Omidyar. As an evergreen fund, Flourish takes a long-term approach and leads seed to Series A rounds typically from $2 million to $7 million into startups like Chime, Neon, and Flutterwave aiming to create systemic change through financial services innovation globally.

The House Fund Closes on $115M (link). The fund is focused on investing primarily at the pre-seed stage, in in Berkeley-affiliated AI startups — whether founded by alumni, faculty, PhD candidates, postdoctoral and grad students, recent graduates, undergraduates or dropouts. The fund can write up to $2M first checks w/ reserves for follow on. As part of the new fund, roboticist, Ken Goldberg will also join as a part-time partner.

Bee Partners Closes $50M Fund IV (link). The firm’s largest fund-to-date, Bee Partners IV will focus on pre-seed deeptech startups. It has already invest 20% of the capital across seven startups including three in the generative AI space.

A Look at Eric Schmidt’s role at Steel Perlot (link). Launched by Schmidt’s girlfriend, Michelle Ritter, Steel Perlot is an accelerator and fund that has taken serious backing from Eric Schmidt who has been described to be a “very, very, active chairman.”

Barclays Announces Black Formation Investments Managed by Zeal Capital Partners (link). BBFI invests in pre-seed Black-led companies who are focused on narrowing the wealth and skills gaps through the development of innovative technologies, tech-enabled services, and platforms. It will also include a $5M scout fund to train the next generation of investors. Shout out to our friend Nasir at Zeal!

Talent Tracker

Fred Ehrsam Steps Away From Paradigm (link). The Coinbase, co-founder is leaving the firm as the crypto-focused fund preps to raise a new fund in 2024 and recover from it’s failed investment in FTX.

Lightspeed Names Aaron Frank as Venture Partner (link). Frank is well known for his role in architecting the Apple Card. Frank will focus on deals in payments and lending.

LP Radar

📽️ Beezer Detailed the $1.4B Sapphire/CalSTRS Emerging Manager Fund (link). I’d note that some backchannel details suggest that this effort wants to prioritize purely US-focused funds as well as increase diversity amongst underrepresented groups in VC. Apart from details of the co-invest arrangement, I’d encourage paying attention to the conversation on Solo GPs (22:00), The Bias Behind Reupping Existing Managers (26:30), and TVPI or DPI (37:00).

German FoF, Equation Buys Betterfront (link). Betterfront helps digitise the VC fundraising process by letting managers share docs and track record analytics with potential LPs. Betterfront has also developed a marketplace for VC secondaries. Equation is interested in Betterfront’s vizualization and data room products to make fundraising easier.

Germany’s KfW Capital Starting €200M Emerging Manager Facility (link). As part of the 10B Future Fund, the EMF will invest in smaller VC funds with €50M in assets under management. There is a preference for funds entering the VC market for the first time and that are managed by women or gender-diverse teams. Funds can receive a maximum of €12.5M and no more than 25% of the fund’s total size.